About Us

Welcome to our VAT & TAX website based in Bangladesh! Our website is designed to provide you with comprehensive and up-to-date information about VAT and Tax regulations in Bangladesh.

We understand that navigating the complex world of taxes can be daunting, especially for small business owners and individuals. That's why we are committed to providing you with easy-to-understand information and resources that can help you comply with the VAT and Tax laws in Bangladesh.

Our team...

More InfoOur Services

To provide Consultancy for preparing of all sorts of VAT Problem and any other services as the company may think fit and proper.

Value Added Tax (VAT)

VAT is based on consumption rather than income. In contrast to a progressive income tax, which levies more taxes on the wealthy, VAT is charged equally on every purchase. More than 160 countries use a VAT system. It is most commonly found in the European Union (EU). Nevertheless, it is not without controversy

Income Tax

Bangladesh adopts a progressive taxation rate on personal income (for resident with presence in Bangladesh: i) for 182 days or more in one fiscal year or ii) for 90 days or more in one fiscal year iii) 365 days or more in preceding 4 years), which ranges from 0% to 25% (surcharge is payable by wealthy individuals).

IRC

To import a registry certificate in Bangladesh, you'll need to follow the necessary procedures and comply with the country's customs regulations. Contact the relevant authorities in Bangladesh, such as the Bangladesh Customs Department or the Ministry of Commerce.

ERC

Exporting a registration certificate from Bangladesh can be important for various reasons, such as participating in international trade, establishing business relationships with foreign entities, or complying with regulatory requirements.

RJSC

In Bangladesh, the registration of Joint Stock Companies is overseen by the Office of the Registrar of Joint Stock Companies and Firms (RJSC). RJSC is under the Ministry of Commerce and is responsible for maintaining the company registry.

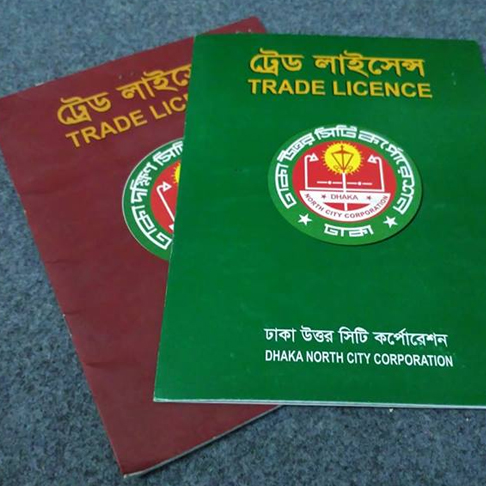

Trade Licence

Trade License is mandatory for every form of business entity in Bangladesh. It is issued by the local government of the respective areas. Every business entity must obtain Trade License from each local government where it operates.

Fire License

A fire license is an important document issued by the fire services. This document ensures the safety of any place. Most of the time factories and industrial establishments as well as multi-storied buildings are required to take fire licenses.Why Choose Us

Our goal is to reduce the stress associated with your legal situation by explaining every step of the process and taking the time to answer your questions.

CERTIFIED EXPERTS

100+ We work buy-side and sell-side – give our clients hard-hitting answers and focus hard on the best opportunities.

CERTIFIED EXPERTS

100+ We work buy-side and sell-side – give our clients hard-hitting answers and focus hard on the best opportunities.